Lately, Matt and I have been focusing on our finances. We have always made pretty good financial decisions, living within our means and saving for retirement, but we didn’t have a clear knowledge of exactly what we were spending money on or what our financial goals were. When we got married and combined our finances, understanding our money became even more important. We started thinking about buying a house in the future, what kind of lifestyle we want to live, and places we want to travel. All of these things require knowing and adjusting how we are handling money right now.

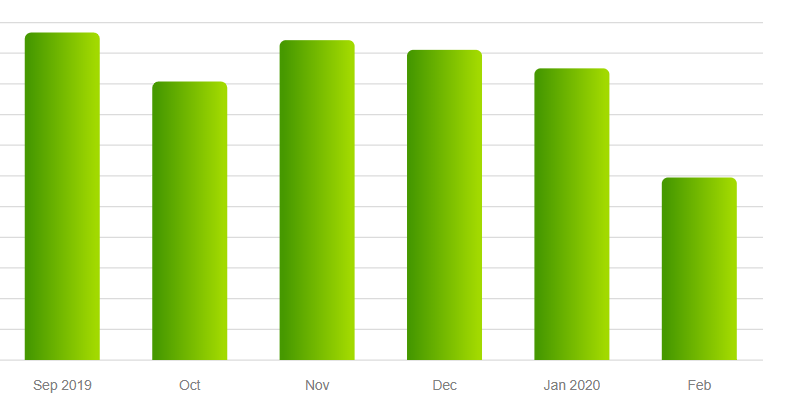

For our budget we use the app, Mint by Intuit, which I think is the coolest technology (and it’s free!). With Mint you can link up each your accounts and credit cards, even 401k accounts, and set up a monthly budget with different categories (food, rent, shopping, etc.) When you make a transaction on any account or credit card it automatically feeds into the app and is sorted into a category. You can go in and check to make sure the category is correct and quickly change it if necessary. Then you can see how much you are over or under your budget in total and by category every month.

For many people, starting a budget is the hardest part. Logistically, even though keeping up with Mint is super easy, getting all the accounts set up takes a while. It took some time to track down the login information for everything we needed and set up the budget categories. There were a few things we weren’t sure how we wanted to categorize, usually costs that come in annually rather than monthly. We decided the most important thing was that everything was being tracked. Writing off an expense as “one time” skews the data and hides what is really being spent. For now we have a pretty big miscellaneous category for those one time expenses, as well as some categories that are zero for most of the year and then all spent in one month (one example is gifts where the majority of the annual budget is spent in December). Over time, it won’t matter which category costs are placed in and we can always adjust them as necessary.

Starting a budget is also emotionally hard. I think this is because we are afraid, we will find something we really don’t like. What if I have been losing money all this time? What if I look back on this data and regret how much money I have thrown away? What if I turn into someone who only cares about money and doesn’t enjoy life right now? What if I disagree with my partner on how to spend money? So far, these things have not happened, or at least not to a large degree. What has happened is feeling security in knowing that I can always check where my money is going and make informed decisions around it.

We started just by tracking our spending . Then after a few months of watching this, we started making decisions and weighing what things were worth for us. Sometimes we still choose a more expensive option, but we know it is something we value. For us this is often money spent on experiences, our health, or to save time. We have had fun coming up with creative ways to save money and are now getting excited about our future goals and learning about investing.

Two resources I have found very enlightening and inspiring are the Frugalwoods blog and Afford Anything podcast. Mrs. Frugalwoods is an awesome author and blogger who became financially independent in her thirties and now lives on a homestead in Vermont. Her blog is super approachable and has money-saving tips on a variety of topics. She also talks about her philosophy which, like ours, is about living intentionally and choice rather than always saving as much money as possible. She talks about the emotional side of money and the ways that gratitude can eliminate the need to spend on short-term indulgences. Her blog also includes reader case studies where people write in with their spending, assets, and goals and get advice. This is super interesting to get a glimpse into other peoples’ lives and financial goals.

Afford Anything is a podcast Matt and I just started listening to and to me it is the next level of financial learning. Listeners call in to ask the host, Paula Pant, for advice on certain decisions. It is much more technical and often discusses investing options, real estate, and business ownership. I don’t always understand all of it, but I feel like the more I listen the more I learn which I want to do sooner rather than later! I am excited to see how finances develop over time for us and would love to hear what others are doing and learning to meet their goals. It might not always be appropriate to discuss money but the more people discuss and share, the greater the chance of learning something that could really make a positive impact.